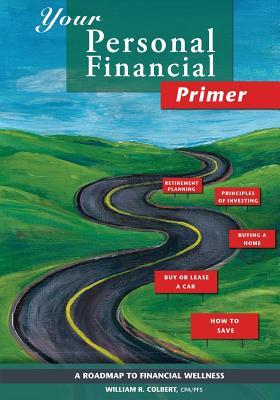

Download Your Personal Financial Primer: A Roadmap to Financial Wellness - William R Colbert file in ePub

Related searches:

4283 3648 2412 2810 3318 4554 2663 132 614 2072 2309 3646 4161 4770 3647 3125 3163 1816 2631 4431 2574 3442 1248 1355 1342 4200 803 3284 3150 405 4001 54 1382 767 2423 2258 885 1101 4206

When planning personal finances, the individual would consider the suitability to his or her needs of a range.

Review and revise the financial plan it is never too early to begin planning. In fact, the earlier you begin planning for your financial future,.

Examples of financial goals are buying a home, sending a child/grandchild to college, traveling in retirement and ultimately not outliving your money! the objective.

Financial plans are written, organized strategies for maintaining financial health and accomplishing financial goals. Developing a personal financial plan will not only allow you to control your financial situation, but can enhance your quality of life by reducing the uncertainty you feel about money-related issues and future needs.

Creating a financially secure life can feel like a daunting task. This personal finance 101 guide lays out seven key steps to get you working toward long-term security.

Personal financial specialist (pfs) accredited in business valuation (abv) chartered global management accountant (cgma) certified in financial forensics (cff) certified information technology professional (citp) certified in entity and intangible valuations (ceiv) certified in the valuation of financial instruments (cvfi).

Celebrity makeup artists share their best tips for how to apply primer. Imaxtree here's the thing: you either like primer or you don't.

Apr 2, 2021 single adults can take steps to work toward a better financial future, even without a partner to help with money matters.

Wouldn't it be nice if there were a magic formula or simple trick that allowed you never to have to worry about money or manage your finances again? while that.

Throughout my career as an accountant and personal financial planner, i found that too many people lacked basic personal financial knowledge. As a result, i was inspired to create a primer to help people grasp the fundamentals of personal finance and gain the confidence and empowerment they need to make intentional financial decisions for themselves and their families.

Step by step instructions for how to complete a personal financial statement. Step by step instruction for how to complete an sba form 413 personal financial.

If you don’t trust yourself to remember to pay your quarterly taxes or periodically pull a credit report, think about setting appointment reminders for these important money to-dos in the same way that you would an annual doctor’s visit or car tune-up.

Teaching units and lesson plans for use in developing personal financial management retirement and tuition for the kids with a primer on investing.

Start saving early, steadily, and master the magic of compounding. The cornerstone to your savings are your personal and retirement saving, assets and social.

Trust premier bank for all of your personal banking and loans, business banking and loans, investment needs and more. With locations throughout ohio� southeast michigan� northeast indiana� and western pennsylvania – as well as online banking� mobile banking and more, you can bank anywhere.

Whether it's large or small, your refund is an opportunity to put your money to work - if you don't spend it right away and all at once. Here are ways to consider using your refund money: pay off debt - in 2016, 27 percent of tax refund recipients used the money to pay down debt, reports money.

Financial literacy is the ability to understand and make use of a variety of financial skills, including personal financial management, budgeting, and investing.

Every board member should be able to read and interpret their organization's financial statements including a balance sheet and income statement. If you or someone you know is struggling to find meaning in all those numbers, download this primer.

Chances are your regular monthly bills aren't nice round numbers like the above example. So when it comes time to transfer money from your personal checking to your bills account, get in the habit of rounding up to the nearest $5 (or even $10).

Jul 9, 2020 because i've followed the financial advice i've reported on for years, i wasn't in terrible shape.

So whether you’re a long-time reader with your black belt in personal finance (btw there’s no such thingalas) or a newbie, let’s dive into the basics of personal finance! how to earn money� ah, perhaps the not so fun part of personal finance; actually working and earning the money.

Financial security is one of the most common life goals around the world. It's the reason why people save, scrimp and budget their money.

February 21, 2021 — 8:00am michael kitces, publisher of the financial planning industry blog nerd's eye view, notes.

We call a personal financial plan simply a formal process for improving your financial life. From organizing your finances so you know where everything is to mapping out goals, establishing.

The next step in building your complete financial portfolio is to develop a plan for paying down high-interest credit card debt. You could use the debt-avalanche method: rank your debts by interest rate: from your balance sheet, rank all of your debts by the interest rate you are paying, starting with the highest.

It involves all financial decisions and activities of an individual or household – the practices of earning, saving, investing and spending.

Oct 13, 2020 what is meant by 'personal finances'? personal finance is a term that covers managing your money as well as saving and investing.

Are you looking for an easy guide to makeup primers? check out our easy guide to makeup primers in this article. Advertisement it's so easy to overdo makeup that many people shy away from primer.

Although it is depends on your personal situation, most financial planners recommend saving enough for at least six months – in both your personal and business expenses. This will set you up for the times when work is harder to come by and will protect you from being in a situation where you take a job you don’t feel good about just because.

Navigating personal finance decisions is more complex than ever. Your position as a trusted adviser in tax, retirement, estate, risk management, and investment planning is critical to helping clients prepare for the future.

Your net worth is the difference between your assets and your liabilities, so your financial statement will allow lenders to determine your net worth. For example, if you have a house and a car with a value of $100,000, and you have a mortgage and car loan for $75,000, your net worth is $25,000.

We found the best face primers to layer under foundation, concealer, and more. Our editors independently research, test, and recommend the best.

Primers are hardworking gems in our beauty arsenal, and there's one for every need - from radiance-boosting formulas to velvety finishes. We earn a commission for products purchased through some links in this article.

Financial planning means putting your incomes and expenses on a scale to achieve monetary equilibrium or upward mobility on your income levels. Your plan should capture how your current and future risks are covered to protect you from econo.

As personal finance author beth kobliner notes in her book get a financial life, when you pay off a credit card bill with a 14% interest rate, “you’re in effect paying yourself 14%, guaranteed, and tax free.

Post Your Comments: